Medicare Tax Brackets 2025. The medicare tax rate for 2025 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. What are the irmaa brackets for 2025 and 2025?

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

What Is The Employee Medicare Tax, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). For 2025, you can accrue one social security or medicare credit for every $1,730 of earnings, up to a maximum of four credits per.

Medicare Blog Moorestown, Cranford NJ, The medicare tax rate for 2025 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. What are the irmaa brackets 2025?

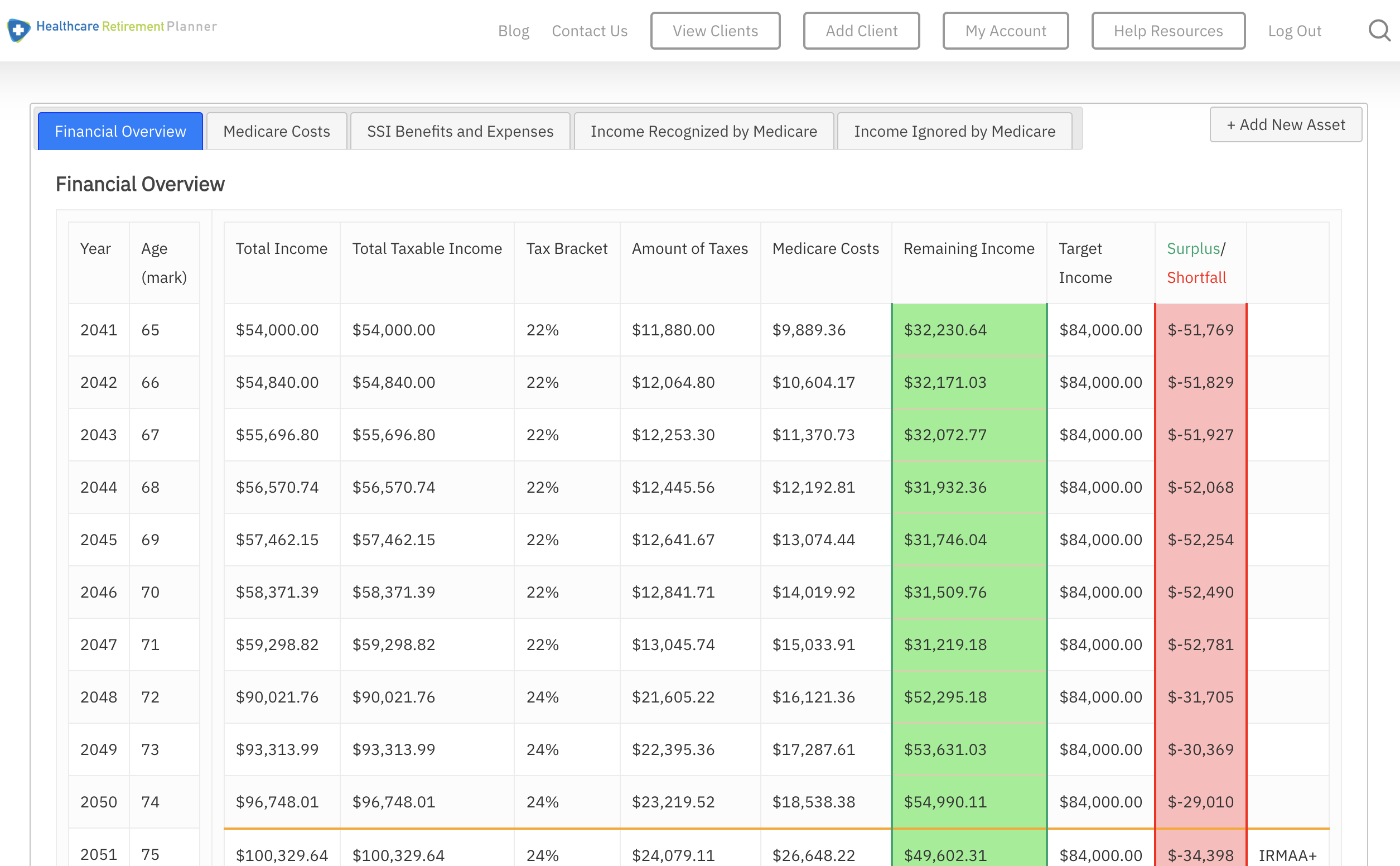

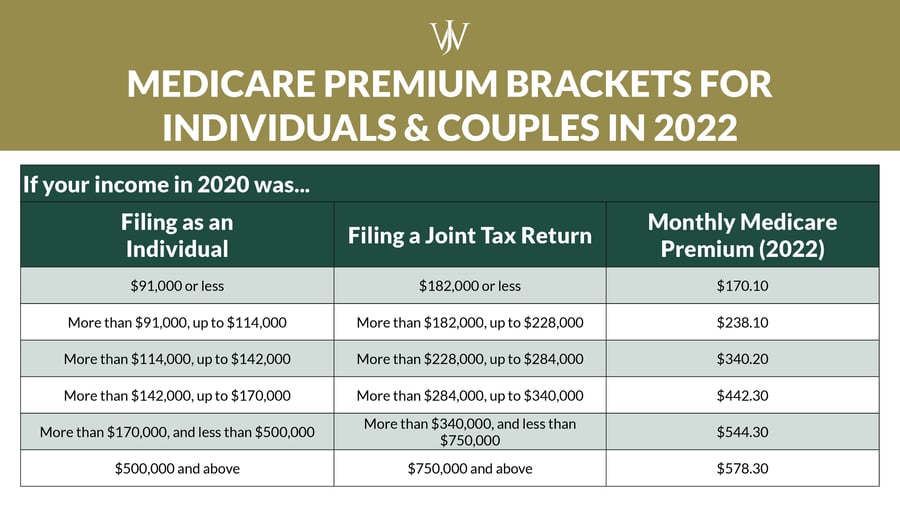

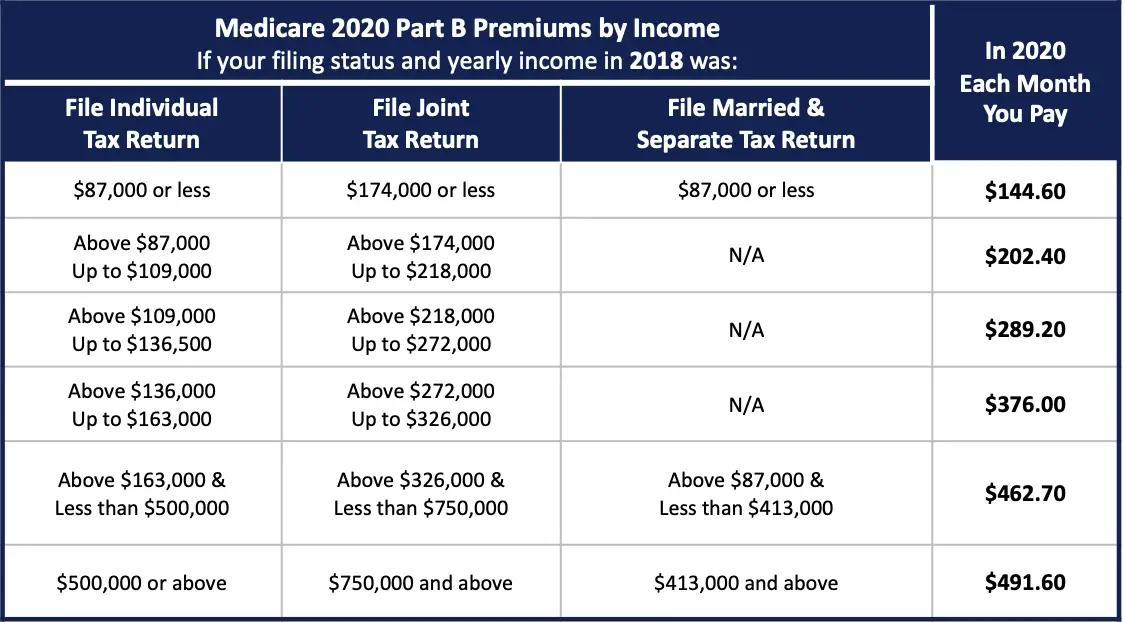

What are the 2025 Medicare Part B Premiums and IRMAA? Independent, Understanding the 2025 irmaa brackets: The amount you’ll pay for your medicare premiums in 2025 hinges on your modified adjusted gross income (magi).

Medicare Deductible 2025 Impact on Retirement Healthcare Plans, What are the irmaa brackets for 2025 and 2025? For 2025, you can accrue one social security or medicare credit for every $1,730 of earnings, up to a maximum of four credits per.

What Are The Irmaa Brackets For 2025 2025 JWG, The fda approved wegovy for the treatment of obesity last year. Social security and medicare tax for 2025.

Tax Planning for Retirees Navigating the Medicare and Social Security, Income thresholds for tax brackets will increase by approximately 5.4% for 2025. Further, the slab rates under the.

How Much Is Medicare Cost A Month, There are seven (7) tax rates in 2025. The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025.

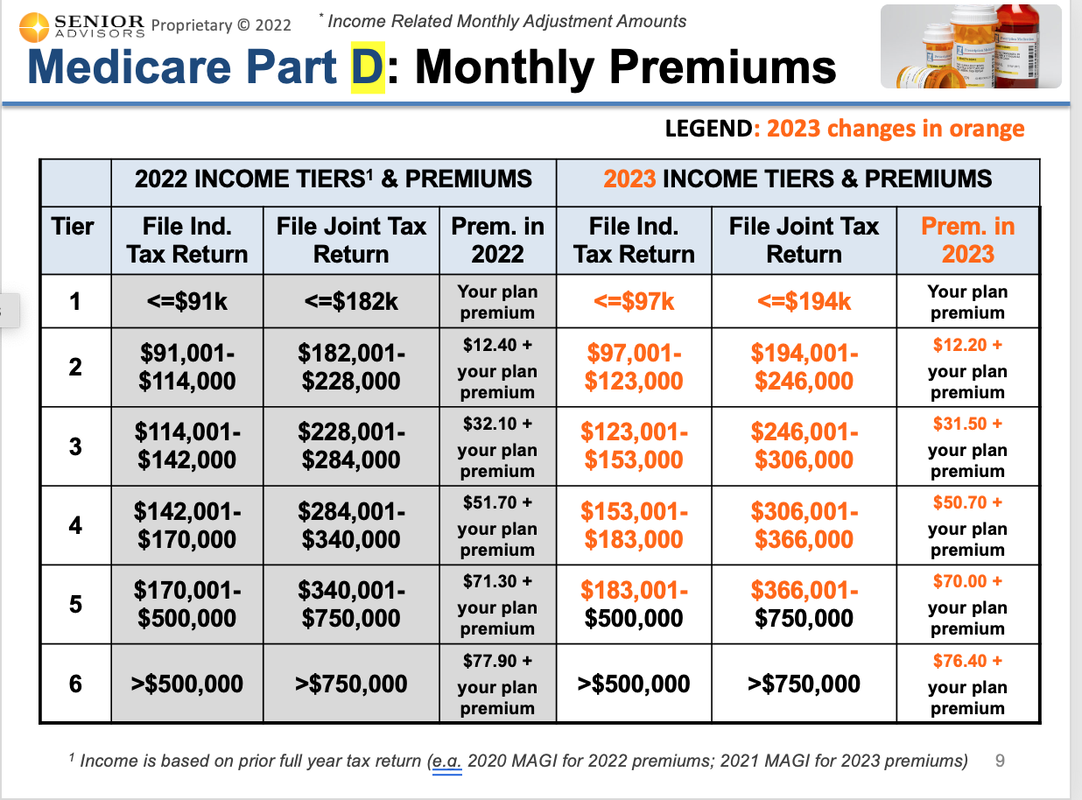

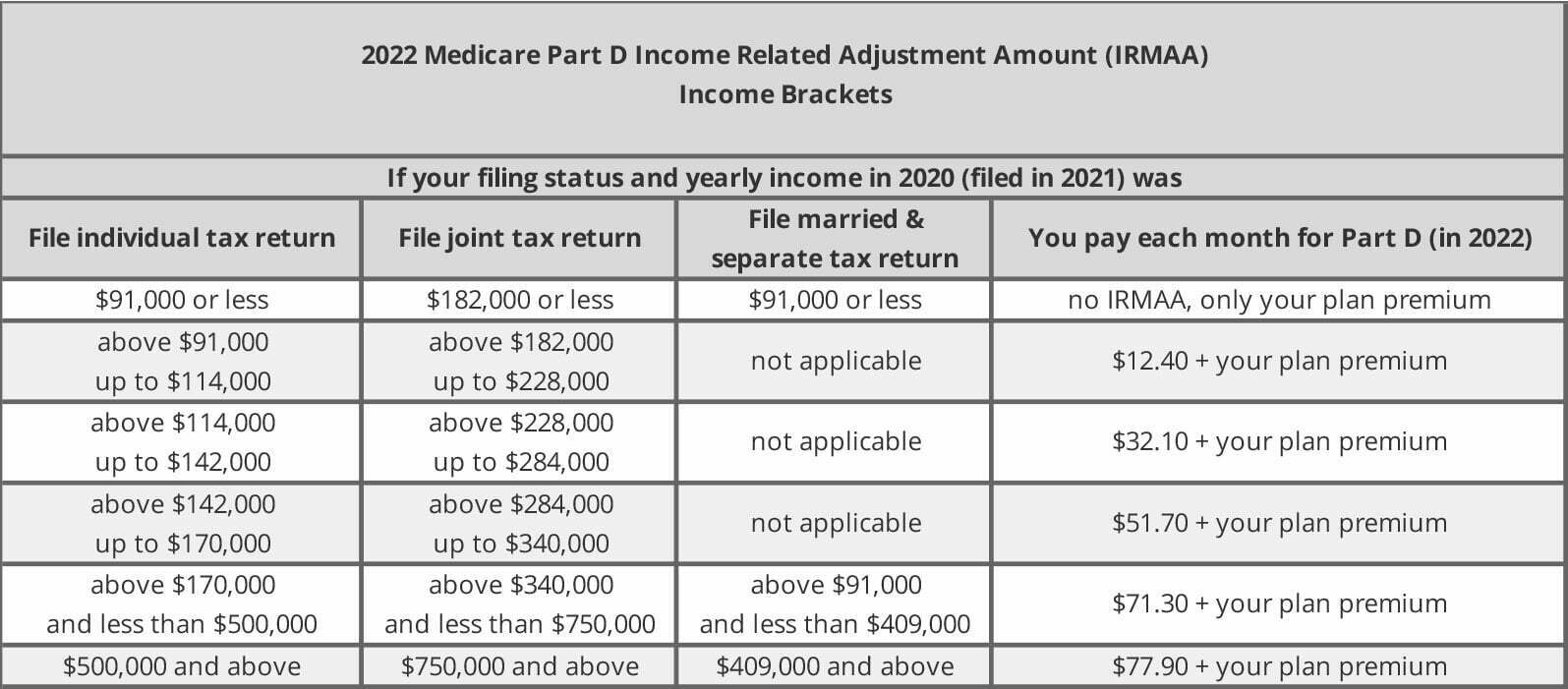

Medicare IRMAA 2025 Updated Thresholds and Surcharges, Income brackets and surcharge amounts for part b and part d irmaa. If you have to pay a premium, you’ll pay as much as $505 per month in 2025, depending on how long you or your spouse worked and paid medicare taxes.

FAQs about Medicare Medicare Insurance Mesa, AZ Roman Brokers, There is no maximum wage limit for the medicare tax. The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025.

What Is the 2025 Medicare Part B Premium and What Are the 2025 IRMAA, If you have to pay a premium, you’ll pay as much as $505 per month in 2025, depending on how long you or your spouse worked and paid medicare taxes. Income tax brackets — for taxable income in 2025.

Last year, congressional republicans chided president joe biden for saying they wanted to cut social security and medicare.